TSX: TML OTCQX: TSRMF

Successful Drilling Campaign leads to Increased Mineral Resource Estimate and Improved Geological Confidence in Gold Mineralization

TORONTO, April 14, 2022 Treasury Metals Inc. (TSX: TML) (OTCQX: TSRMF) (“Treasury” or the Company”) is pleased to announce the results of the Updated Mineral Resource Estimate (the “MRE”) for its Goliath Gold Complex located in northwestern Ontario (the “Project” or “GGC”), which includes the Goliath (“Goliath”), Goldlund (“Goldlund”) and Miller (“Miller”) deposits.

The updated MRE is based on a total of 3,185 drill holes measuring 540,329 metres for the Goliath, Goldlund and Miller deposits, incorporating 176 new drill holes and 41,072 metres since the mineral resource estimate set out in the March 2021 Preliminary Economic Assessment (the “PEA”) of the Goliath Gold Complex (the “PEA MRE”). This MRE will form the basis for the pre-feasibility study (“PFS”) on the Project, which the Company expects to complete in the second half of 2022.

Highlights:

- Increased combined Measured and Indicated Mineral Resources for the entire GGC by 9% to 2,138,600 Au ounces;

- Increased Inferred Mineral Resources for the entire GGC by 48% to 782,800 Au ounces;

- Increased confidence in Goliath, with an increase to the Measured Resources from 105,000 Au ounces to 273,600 Au ounces at an average grade of 1.33 g/t Au;

- Successfully converted Miller deposit from a 79,000 Au ounce Inferred Mineral Resource to an Indicated Mineral Resource of 74,600 Au ounces at 1.10 g/t Au;

- Increased Goldlund Indicated Mineral Resource from 840,000 Au ounces to 940,000 Au ounces at 0.87 g/t Au;

- Increased Goldlund Inferred Mineral Resource from 311,000 Au ounces at 0.66 g/t Au to 703,500 Au ounces at 0.75 g/t Au;

- 62% of the combined Measured and Indicated Mineral Resource Au ounces are above 1.00 g/t cut-off grade and 40% above 2.20 g/t cut-off grade; and

- Improved geological confidence and better representation of deposits

Jeremy Wyeth, President and CEO of Treasury Metals, commented: “We are pleased to announce our updated mineral resource estimate for the Goliath Gold Complex that shows a 9% increase in Measured and Indicated Mineral Resources to more than 2.1 million ounces of gold and a 48% increase in Inferred Mineral Resources to more than 780,000 ounces of gold. In June 2021, we committed to growing the Mineral Resource with the addition and conversion of tonnes and ounces through the 2021 drill program and geological modelling, which the team delivered on.

Mr. Wyeth continued: “I am looking forward to seeing how our updated MRE will contribute to our initial Mineral Reserve and the outcome of the PFS, which we anticipate completing in the second half of 2022. The combination of our engineering efforts and the Project’s access to world-class infrastructure will help us to deliver mine plan growth from PEA to PFS. We also intend to continue exploration activities on the Goliath Gold Complex and our 330 sq km land package through 2022. Building on the discoveries at Caracal and Ocelot we made earlier this year, we expect to continue to grow our multi-million-ounce deposit along our 65 km strike length.”

Updated Mineral Resource Estimate

Table 1: Goliath Gold Complex Mineral Resource Estimate

|

Goliath Gold Complex Total (effective January 17, 2022) |

|||||||

|

Type |

Classification |

Cut-off11 |

Tonnes |

Au (g/t) |

Au (Oz) |

Ag (g/t)10 |

Ag (Oz) |

|

Open Pit |

Measured |

0.25 / 0.3 |

6,223,000 |

1.20 |

239,500 |

4.70 |

940,600 |

|

Indicated |

0.25 / 0.3 |

58,546,000 |

0.82 |

1,545,000 |

2.53 |

1,878,500 |

|

|

Meas+Ind |

0.25 / 0.3 |

64,769,000 |

0.86 |

1,784,500 |

2.99 |

2,819,100 |

|

|

Inferred |

0.25 / 0.3 |

32,301,000 |

0.73 |

754,900 |

0.80 |

85,200 |

|

|

Underground |

Measured |

2.20 |

170,000 |

6.24 |

34,100 |

22.34 |

122,100 |

|

Indicated |

2.20 |

2,772,000 |

3.59 |

320,000 |

7.08 |

580,800 |

|

|

Meas+Ind |

2.20 |

2,942,000 |

3.74 |

354,100 |

8.04 |

702,900 |

|

|

Inferred |

2.20 |

270,000 |

3.21 |

27,900 |

4.06 |

6,300 |

|

|

Total |

Measured |

6,393,000 |

1.33 |

273,600 |

5.17 |

1,062,700 |

|

|

Indicated |

61,318,000 |

0.95 |

1,865,000 |

2.98 |

2,459,300 |

||

|

Meas+Ind |

67,711,000 |

0.98 |

2,138,600 |

3.42 |

3,522,000 |

||

|

Inferred |

32,571,000 |

0.75 |

782,800 |

0.84 |

91,500 |

||

- Mineral Resources were estimated by ordinary kriging by Dr. Gilles Arseneau, associate consultant of SRK Consulting (Canada) Inc., Mineral Resources were prepared in accordance with NI 43-101 and the CIM Definition Standards for Mineral Resources and Mineral Reserves (2014) and the CIM Estimation of Mineral Resources and Mineral Reserves Best Practice Guidelines (2019). This estimate of Mineral Resources may be materially affected by environmental, permitting, legal, title, taxation, sociopolitical, marketing, or other relevant issues. Mineral Resources that are not mineral reserves do not have demonstrated economic viability.

- Mineral Resource effective date January 17, 2022.

- Goliath Open Pit Mineral Resources are reported within an optimized constraining shell at a cut-off grade of 0.25 g/t gold that is based on a gold price of US$1,700/oz, a silver price of US$23/oz, and a gold and silver processing recovery of 93.873*Au(g/t)^0.021 and 60% respectively.

- Goldlund Open Pit Mineral Resources are reported within an optimized constraining shell at a cut-off grade of 0.3 g/t gold that is based on a gold price of US$1,700/oz and a gold processing recovery of 90.344*Au(g/t)^0.0527.

- Miller Open Pit Mineral Resources are reported within an optimized constraining shell at a cut-off grade of 0.3 g/t gold that is based on a gold price of US$1,700/oz and a gold processing recovery of 93.873*Au(g/t)^0.021.

- Goliath Underground Mineral Resources are reported inside shapes generated from Deswick Mining Stope Optimiser (DSO) at a cut-off grade of 2.2g/t gold that is based on a gold price of US$1,700/oz, a silver price of US$23/oz, and a gold and silver processing recovery of 93.873*Au(g/t)^0.021 and 60% respectively.

- Goldlund Underground Mineral Resources are reported inside DSO shapes at a cut-off grade of 2.2g/t gold that is based on a gold price of US$1,700/oz and a gold processing recovery of 90.344*Au(g/t)^0.0527.

- Gold and Silver assays were capped prior to compositing based on probability plot analysis for each individual zones. Assays were composited to 1.5 m for Goliath, 2.0 m for Goldlund and 1.0 m for Miller.

- Excludes unclassified mineralization located within mined out areas.

- Silver grade and ounces are derived from the Goliath tonnage only.

- Goliath Open Pit and Goldlund/Miller cut-off grades are 0.25g/t and 0.30g/t, respectively.

- All figures are rounded to reflect the estimates’ relative accuracy, and totals may not add correctly.

The Treasury Metals geology team worked with SRK to select the best modelling approaches for each deposit. Improved geological models were constructed for each deposit to support the block model updates. The goal for the geological models and block models was to ensure each deposit was as well represented as possible. Specific attention was placed on capturing the higher-grade mineralization while not allowing those grades to mistakenly influence the surrounding lower-grade halos.

The 2021 drill program targeted Mineral Resource conversion to higher confidence levels, overall resource growth and strengthening geological understanding for the Goliath Gold Complex. The 176 new holes that went into this MRE update have improved the confidence of the Mineral Resource converting 173,600 ounces of gold from Inferred to the Measured and Indicated categories. In addition, the Inferred Mineral Resource has grown by 254,800 ounces of gold. The Goliath Gold Complex has grown to 2,138,600 ounces of gold in the Measured and Indicated Mineral Resource categories and 782,800 ounces of gold included in the Inferred Mineral Resource category (see Table 1).

Maura Kolb, Director of Exploration for Treasury Metals, commented, “We are pleased with the geological improvements made in this MRE update. We feel the mineralization is well represented through the methods used for estimation. The work done by the team to capture the geological controls and mineralization styles for Goliath, Goldlund and Miller are being used to further develop our 2022 exploration program. As shown by the last two press releases related to Caracal and Ocelot (February 17, 2022 and March 16, 2022), the property holds potential for new discoveries of Goldlund/Miller style mineralization. Knowledge gained from our work on the Goliath model are being deployed in the exploration of the Far East, South Syncline and Fold Nose targets. We are using the lower-grade halo alteration and mineralization to vector in on the higher-grade “core” mineralization.”

Goliath Mineral Resource Estimate

Table 2: Goliath Mineral Resource Estimate

|

Goliath (effective January 17, 2022.) |

|||||||

|

Type |

Classification |

Cut-off |

Tonnes |

Au (g/t) |

Au (Oz) |

Ag (g/t) |

Ag (Oz) |

|

Open Pit |

Measured |

0.25 |

6,223,000 |

1.20 |

239,500 |

4.70 |

940,600 |

|

Indicated |

0.25 |

23,081,000 |

0.75 |

559,400 |

2.53 |

1,878,500 |

|

|

Meas+Ind |

0.25 |

29,304,000 |

0.85 |

798,900 |

2.99 |

2,819,100 |

|

|

Inferred |

0.25 |

3,330,000 |

0.66 |

70,200 |

0.80 |

85,200 |

|

|

Underground |

Measured |

2.20 |

170,000 |

6.24 |

34,100 |

22.34 |

122,100 |

|

Indicated |

2.20 |

2,550,000 |

3.55 |

291,000 |

7.08 |

580,800 |

|

|

Meas+Ind |

2.20 |

2,720,000 |

3.72 |

325,100 |

8.04 |

702,900 |

|

|

Inferred |

2.20 |

48,000 |

2.95 |

4,600 |

4.06 |

6,300 |

|

|

Total |

Measured |

6,393,000 |

1.33 |

273,600 |

5.17 |

1,062,700 |

|

|

Indicated |

25,631,000 |

1.03 |

850,400 |

2.98 |

2,459,300 |

||

|

Meas+Ind |

32,024,000 |

1.09 |

1,124,000 |

3.42 |

3,522,000 |

||

|

Inferred |

3,378,000 |

0.69 |

74,800 |

0.84 |

91,500 |

||

- Refer to the Notes on the Mineral Resource Estimate in Table 1 of this Press Release

The updated MRE for Goliath is based on a total of 900 drill holes measuring 289,360 metres, incorporating 35 drill holes and 16,616 metres from the 2021 drilling campaign. 2021 drilling targeted extension of underground mineralization and improved confidence of western open pit mineralization.

The geology team worked with SRK in selecting the most suitable modelling approach for the Goliath style of mineralization. The Goliath deposit is hosted by altered felsic rocks with sulphide mineralization. The higher-grade mineralization is characterized by intense alteration and mineralization and is surrounded by lessening halo alteration and mineralization. To capture this style of mineralization, the geology team employed a traditional approach to the block model estimation using wireframes for the higher-grade and lower-grade domains. The purpose was to represent the higher-grade mineralization and lower-grade halo mineralization separately. Addressing the higher-grade and lower-grade domains in this manner allows for the strike and dip continuity of the Goliath deposit to be well represented without creating a false spread of grade in the width direction.

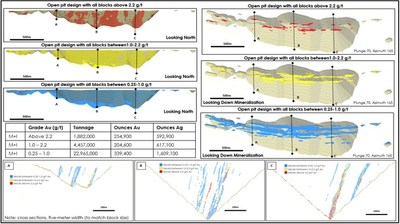

The block model estimates a grade for each individual block within the deposit. In Figure 1, the resource block model can be seen at various grade intervals. The first interval, shown in red, represents all blocks above 2.2 g/t and the second interval, shown in yellow, represents all blocks grading from 1.0 g/t to 2.2 g/t. The red and yellow blocks illustrate the higher-grade “core” mineralization at Goliath. The reason for the 2.2 g/t interval is to compare the higher-grade within the pit to the higher grade in the underground shape. In the Measured and Indicated Mineral Resource categories, there are 6,339,000 tonnes and 459,500 ounces of gold with a grade above 1.0 g/t captured in the Goliath open pit and 1,882,000 tonnes and 254,900 ounces of gold above 2.2 g/t.

The final grade interval, shown in blue, represents all the blocks above 0.25 g/t Au and up to 1.0 g/t Au. This grade interval reflects the lower-grade halo mineralization. The three example cross-sections in the lower section of Figure 1 characterize the relationship between these different grade intervals.

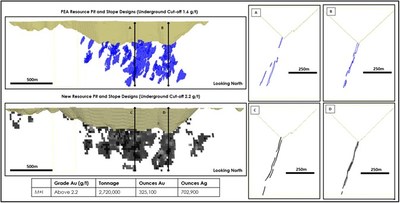

Figure 2 compares the underground designs between the PEA MRE and this MRE update. The top image shows the PEA MRE open pit and underground designs looking North. The bottom image shows the current MRE open pit and underground designs. Changes were made to the MRE methodology at Goliath to better capture the geometry and continuity of the mineralization. Goliath has higher-grade “core” mineralization, which shows better continuity in the strike and dip directions than it does across the width of the zone. Note the improved continuity of the underground stope designs in the MRE in the strike and dip directions even with the increased cut off grade of 2.2 g/t Au versus the previous 1.6 g/t Au cut-off grade. The updated Goliath underground MRE has 325,100 ounces of gold at an average grade of 3.72 g/t Au in the Measured and Indicated Mineral Resource category. This is a 46,100-ounce increase and a positive 0.49 g/t average grade improvement from the Measured and Indicated category PEA MRE.

Goldlund Mineral Resource Estimate

Goldlund was the primary focus of the 2021 drill campaign, with 68% of the total holes drilled for this MRE update. The updated MRE for Goldlund is based on a total of 2,197 drill holes measuring 240,601 metres, incorporating 120 drill holes and 21,474 metres from the 2021 drilling campaign. The 2021 drilling campaign targeted the conversion of the Inferred Mineral Resource, much of which was halo mineralization at lower grades located within the open pit. In addition, higher-grade mineralization was targeted at depth, increasing the confidence and depth of the Mineral Resource open pit. At Goldlund, 100,000 ounces of gold were converted to Measured and Indicated Mineral Resources through the 2021 drill campaign, and an additional 392,500 ounces of gold were added to the Inferred Mineral Resource category.

Table 3: Goldlund Resource Table

|

Goldlund (effective January 17, 2022.) |

|||||

|

Type |

Classification |

Cut-off |

Tonnes |

Au (g/t) |

Au (Oz) |

|

Open Pit |

Measured |

0.30 |

0 |

0.00 |

0 |

|

Indicated |

0.30 |

33,353,000 |

0.85 |

911,000 |

|

|

Meas+Ind |

0.30 |

33,353,000 |

0.85 |

911,000 |

|

|

Inferred |

0.30 |

28,833,000 |

0.73 |

680,200 |

|

|

Underground |

Measured |

2.20 |

0 |

0.00 |

0 |

|

Indicated |

2.20 |

222,000 |

4.06 |

29,000 |

|

|

Meas+Ind |

2.20 |

222,000 |

4.06 |

29,000 |

|

|

Inferred |

2.20 |

222,000 |

3.26 |

23,300 |

|

|

Total |

Measured |

0 |

0.00 |

0 |

|

|

Indicated |

33,575,000 |

0.87 |

940,000 |

||

|

Meas+Ind |

33,575,000 |

0.87 |

940,000 |

||

|

Inferred |

29,055,000 |

0.75 |

703,500 |

||

- Refer to the Notes on the Mineral Resource Estimate in Table 1 of this Press Release

The geology team created a litho-structural model for Goldlund focused on capturing the different styles of mineralization. The mineralized domains have now been defined on host rock and style, rather than geochemical continuity as was the case in the previous interpretation. Care was taken to review historic logs and core photos to group these zones by styles of mineralization and host rock.

Unlike Goliath, the higher-grade mineralization at Goldlund cannot be easily captured in wireframes. This is due to the narrow nature of the veins which occur in multiple orientations. The only exception is the higher-grade mineralization associated with Zone 1, where veining occurs at a geological contact and higher grades adhere to this boundary. Here wireframes were created to limit the influence of the higher-grade contact hosted mineralization. For mineralization that could not be captured in discrete wireframes, a probabilistic approach was used, just as in the PEA MRE. To eliminate grade spreading to areas not geologically favourable for gold, only blocks defined within the mineralized domains were assigned estimated values for gold for the current MRE.

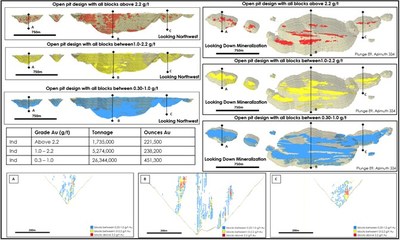

In Figure 3, the resource block model for Goldlund can be seen at various grade intervals. The first grade interval, shown in red, represents all blocks above 2.2 g/t, and the second grade interval, shown in yellow, represents all blocks grading 1.0 g/t to 2.2 g/t Au. The red and yellow blocks illustrate the higher-grade “core” mineralization at Goldlund. There are 5,274,000 tonnes and 238,200 ounces of gold in the Indicated Mineral Resource category with a grade above 1.0 g/t captured in the Goldlund open pit, and there are 1,735,000 tonnes and 221,500 ounces of gold above 2.2 g/t.

The final grade interval, shown in blue, represents all the blocks above 0.30 g/t Au and up to 1.0 g/t Au. This grade interval reflects the lower-grade halo mineralization. The three example cross-sections in the lower section of Figure 2 characterize the relationship between these different grade intervals at the Goldlund deposit.

Miller Mineral Resource Estimate

Table 4: Miller Mineral Resource Estimate

|

Miller (effective January 17, 2022.) |

|||||

|

Type |

Classification |

Cut-off |

Tonnes |

Au (g/t) |

Au (Oz) |

|

Open Pit |

Measured |

0.30 |

0 |

0 |

0 |

|

Indicated |

0.30 |

2,112,000 |

1.10 |

74,600 |

|

|

Meas+Ind |

0.30 |

2,112,000 |

1.10 |

74,600 |

|

|

Inferred |

0.30 |

138,000 |

1.01 |

4,500 |

|

- Refer to the Notes on the Mineral Resource Estimate in Table 1 of this Press Release

The updated MRE for Miller is based on a total of 61 drill holes measuring 10,368 metres, incorporating 21 drill holes and 2,982 metres from the 2021 drilling campaign. The 21 drill holes completed in the 2021 program has improved confidence at Miller, converting 74,600 ounces of gold to the Indicated Mineral Resource category. The geology team used the new drilling to create an updated geology model for Miller comprising the two host lithologies.

Mineral Resource Estimate Sensitivity

The MRE sensitivity table (Table 5) shows the potential for additional resources through optimizing costs and cut-off grade which will be reviewed during pre-feasibility work.

Table 5: Cut-Off Grade Sensitivity

|

Class |

Goliath Open Pit (January 17, 2022) |

Goldlund Open Pit (January 17, 2022) |

Miller Open Pit (January 17, 2022) |

|||||||||||

|

Cut-off |

Tonnes |

Au Grade |

Au |

Cut-off |

Tonnes |

Au Grade |

Au |

Cut-off |

Tonnes |

Au Grade |

Au |

|||

|

Measured |

>0.6 |

2,824,000 |

2.18 |

197,800 |

>0.6 |

0 |

0 |

0 |

>0.6 |

0 |

0 |

0 |

||

|

>0.5 |

3,321,000 |

1.93 |

206,600 |

>0.5 |

0 |

0 |

0 |

>0.5 |

0 |

0 |

0 |

|||

|

>0.4 |

4,122,000 |

1.65 |

218,100 |

>0.4 |

0 |

0 |

0 |

>0.4 |

0 |

0 |

0 |

|||

|

>0.3 |

5,397,000 |

1.34 |

232,200 |

>0.3 |

0 |

0 |

0 |

>0.3 |

0 |

0 |

0 |

|||

|

>0.25 |

6,223,000 |

1.2 |

239,500 |

>0.25 |

0 |

0 |

0 |

>0.25 |

0 |

0 |

0 |

|||

|

>0.2 |

7,092,000 |

1.08 |

245,800 |

>0.2 |

0 |

0 |

0 |

>0.2 |

0 |

0 |

0 |

|||

|

Indicated |

>0.6 |

8,441,000 |

1.41 |

384,000 |

>0.6 |

15,489,000 |

1.34 |

667,400 |

>0.6 |

1,286,000 |

1.52 |

63,000 |

||

|

>0.5 |

10,369,000 |

1.25 |

417,800 |

>0.5 |

19,594,000 |

1.17 |

739,500 |

>0.5 |

1,510,000 |

1.38 |

66,900 |

|||

|

>0.4 |

13,452,000 |

1.07 |

462,000 |

>0.4 |

25,261,000 |

1.01 |

820,900 |

>0.4 |

1,794,000 |

1.23 |

71,100 |

|||

|

>0.3 |

18,966,000 |

0.86 |

523,200 |

>0.3 |

33,353,000 |

0.85 |

911,000 |

>0.3 |

2,112,000 |

1.1 |

74,600 |

|||

|

>0.25 |

23,081,000 |

0.75 |

559,400 |

>0.25 |

38,706,000 |

0.77 |

958,100 |

>0.25 |

2,302,000 |

1.03 |

76,300 |

|||

|

>0.2 |

28,168,000 |

0.66 |

596,100 |

>0.2 |

45,218,000 |

0.69 |

1,005,000 |

>0.2 |

2,503,000 |

0.97 |

77,800 |

|||

|

Inferred |

>0.6 |

1,185,000 |

1.16 |

44,000 |

>0.6 |

13,903,000 |

1.06 |

471,800 |

>0.6 |

80,000 |

1.43 |

3,700 |

||

|

>0.5 |

1,477,000 |

1.04 |

49,200 |

>0.5 |

17,956,000 |

0.94 |

542,800 |

>0.5 |

94,000 |

1.3 |

3,900 |

|||

|

>0.4 |

2,003,000 |

0.88 |

56,700 |

>0.4 |

22,850,000 |

0.83 |

613,300 |

>0.4 |

112,000 |

1.17 |

4,200 |

|||

|

>0.3 |

2,785,000 |

0.73 |

65,500 |

>0.3 |

28,833,000 |

0.73 |

680,200 |

>0.3 |

138,000 |

1.01 |

4,500 |

|||

|

>0.25 |

3,330,000 |

0.66 |

70,300 |

>0.25 |

32,137,000 |

0.69 |

709,300 |

>0.25 |

151,000 |

0.95 |

4,600 |

|||

|

>0.2 |

4,095,000 |

0.58 |

75,700 |

>0.2 |

35,569,000 |

0.64 |

734,100 |

>0.2 |

163,000 |

0.89 |

4,700 |

|||

- Refer to the Notes on the Mineral Resource Estimate in Table 1 of this Press Release

Goliath Gold Complex Mineral Resource Estimate Comparisons

Table 6: Comparison between the 2021 PEA MRE and Updated MRE Input Parameters

|

Parameters |

Units |

PEA MRE |

New MRE |

|

Gold Price |

$/oz Au |

1,700 |

1,700 |

|

Silver Price |

$/oz Ag |

23 |

23 |

|

US$ to CA$ |

0.75 |

0.75 |

|

|

Recovery / Regression Au Goliath |

% |

95.5 |

93.873*Au^0.021 |

|

Recovery / Regression Au Goldlund |

% |

89 |

90.344xAu^0.0527 |

|

Recovery / Regression Au Miller |

% |

89 |

93.873*Au^0.021 |

|

Recovery Ag Goliath |

% |

62.6 |

60 |

|

Goliath Open Pit Cut-off Grade |

g/t |

0.24 |

0.25 |

|

Goldlund Open Pit Cut-off Grade |

g/t |

0.26 |

0.30 |

|

Miller Open Pit Cut-off Grade |

g/t |

0.26 |

0.30 |

|

Goliath Underground Cut-off Grade |

g/t |

1.60 |

2.20 |

|

Goldlund Underground Cut-off Grade |

g/t |

1.60 |

2.20 |

Table 7: Comparison between the 2021 PEA MRE and Updated MRE

|

Comparison - Goliath Gold Complex Total |

||||||||||

|

Deposit |

Type |

Class |

Cut-Off Grade |

Kilo Tonnes (kt) |

Au (g/t) |

Au (Oz) |

||||

|

2021 PEA MRE |

Updated MRE |

2021 |

Updated MRE |

2021 PEA MRE |

Updated MRE |

2021 PEA MRE |

Updated MRE |

|||

|

Goliath |

Open Pit |

Meas |

0.25 |

0.25 |

1,471 |

6,223 |

1.90 |

1.20 |

90,000 |

239,500 |

|

Goliath |

Underground |

Meas |

1.60 |

2.20 |

98 |

170 |

4.94 |

6.24 |

16,000 |

34,100 |

|

Total Measured |

1,569 |

6,393 |

2.09 |

1.33 |

105,000 |

273,600 |

||||

|

Goliath |

Open Pit |

Ind |

0.25 |

0.25 |

26,956 |

23,081 |

0.87 |

0.75 |

757,000 |

559,400 |

|

Goliath |

Underground |

Ind |

1.60 |

2.20 |

2,592 |

2,550 |

3.16 |

3.55 |

263,000 |

291,000 |

|

Goldlund |

Open Pit |

Ind |

0.26 |

0.30 |

24,300 |

33,353 |

1.07 |

0.85 |

840,000 |

911,000 |

|

Goldlund |

Underground |

Ind |

N/A |

2.20 |

0 |

222 |

N/A |

4.06 |

0 |

29,000 |

|

Miller |

Open Pit |

Ind |

N/A |

0.30 |

0 |

2,112 |

N/A |

1.10 |

0 |

74,600 |

|

Total Indicated |

53,848 |

61,318 |

1.07 |

0.95 |

1,860,000 |

1,865,000 |

||||

|

Total Measured & Indicated |

55,417 |

67,711 |

1.10 |

0.98 |

1,965,000 |

2,138,600 |

||||

|

Goliath |

Open Pit |

Inf |

0.25 |

0.25 |

3,644 |

3,330 |

0.65 |

0.66 |

76,000 |

70,200 |

|

Goliath |

Underground |

Inf |

1.60 |

2.20 |

704 |

48 |

2.75 |

2.98 |

62,000 |

4,600 |

|

Goldlund |

Open Pit |

Inf |

0.26 |

0.30 |

14,400 |

28,833 |

0.56 |

0.73 |

260,000 |

680,200 |

|

Goldlund |

Underground |

Inf |

1.60 |

2.20 |

233 |

222 |

6.80 |

3.26 |

51,000 |

23,300 |

|

Miller |

Open Pit |

Inf |

0.26 |

0.30 |

1,981 |

138 |

1.24 |

1.01 |

79,000 |

4,500 |

|

Total Inferred |

20,962 |

32,571 |

0.78 |

0.75 |

528,000 |

782,800 |

||||

- The reader is cautioned not to misconstrue this tabulation as a Mineral Resource estimate. Listed Gold ounces, grades and tonnes are shown for comparison purposes only

- Mineral Resource statement, including a breakdown of contained metal ounces and grades by gold and silver, can be found in Table 1 of this press release

- Mineral Resources are reported above a cut-off grade in which cut-off grade accounts for metallurgical recoveries of Au, and Ag as well as underlying cost and metal price assumptions

- The gold (US$1,700/oz) and silver (US$23/oz) price assumptions used in the MRE are consistent with the metal price assumptions employed within the PEA MRE

- Additional information on the PEA MRE is set out in the PEA.

It is important to note that this updated MRE has not yet been applied to the PEA. The PEA is based on the Technical Report (as defined below). The updated MRE contained in this news release does not have a negative impact on or otherwise adversely affect the MRE that formed the basis of the PEA, as there was additional drilling and changes were made to the MRE methodology to better capture the geometry and continuity of the mineralization. Treasury does not feel that it is necessary to update the PEA at this time as it is working towards a pre-feasibility study, which will incorporate this updated MRE. However, the PEA remains valid based on the smaller MRE estimate contained in the Technical Report.

QA / QC

The Company has implemented a quality assurance and quality control (QA/QC) program to ensure sampling and analysis of all exploration work is conducted in accordance with the CIM Exploration Best Practices Guidelines. The drill core is sawn in half with one-half of the core sample dispatched to Activation Laboratories Ltd. facility located in Dryden, Ontario, which is an independent laboratory to the Company. The other half of the core is retained for future assay verification and/or metallurgical testing. Other QA/QC procedures include the insertion of blanks and Canadian Reference Standards for every tenth sample in the sample stream. A quarter core duplicate is assayed every 20th sample. The laboratory has its own QA/QC protocols running standards and blanks with duplicate samples in each batch stream. Additional checks are routinely run on anomalous values including gravimetric analysis and pulp metallic screen fire assays. Gold analysis is conducted by lead collection, fire assay with atomic absorption and/or gravimetric finish on a 50-gram sample. Check assays are conducted at a secondary ISO certified and independent laboratory (in this case AGAT Laboratories located in Mississauga, Ontario) following the completion of a program.

Qualified Persons

Maura Kolb, M.Sc., P.Geo., Director of Exploration and Adam Larsen, P. Geo., Exploration Manager, are both considered “Qualified Persons” for the purposes of National Instrument 43-101 - Standards of Disclosure for Mineral Projects (“NI 43-101”) and have reviewed and approved the scientific and technical disclosure contained in this news release on behalf of Treasury. The Qualified Persons have verified the data underlying the updated MRE contained in this news release. There were no limitations imposed on the Qualified Persons verification of the data.

About Treasury Metals Inc.

Treasury Metals Inc. is a gold-focused company with assets in Canada. Treasury’s Goliath Gold Complex, which includes the Goliath, Goldlund and Miller deposits, is located in Northwestern Ontario. The deposits benefit substantially from excellent access to the Trans-Canada Highway, related power and rail infrastructure, and close proximity to several communities including Dryden, Ontario. The Company also owns several other projects throughout Canada, including the Lara Polymetallic Project, Weebigee-Sandy Lake Gold Project JV, and grassroots gold exploration property Gold Rock. Treasury Metals is committed to inclusive, informed and meaningful dialogue with regional communities and Indigenous Nations throughout the life of all our Projects and on all aspects, including: creating sustainable economic opportunities, providing safe workplaces, enhancing of social value, and promoting community well-being.

For information on the Goliath Gold Complex, please refer to the preliminary economic assessment, prepared in accordance with NI 43-101, entitled “NI 43–101 Technical Report & Preliminary Economic Assessment of the Goliath Gold Complex” and dated March 10, 2021 with an effective date of January 28, 2021 (the “Technical Report”), led by independent consultants Ausenco Engineering Canada Inc. The Technical Report is available under the Company’s issuer profile on SEDAR at www.sedar.com, on the OTCQX at www.otcmarkets.com and on the Company website at www.treasurymetals.com.

To view further details about Treasury Metals, please visit the Company’s website at www.treasurymetals.com.

Forward-Looking Statements

This news release includes certain statements that may be deemed to be “forward-looking information” and “forward-looking statements” pursuant to applicable securities laws, including but not limited to, the MRE, the price of metals, the completion of a pre-feasibility study, future exploration and mineralization and the development of the Goliath project. All statements in this release, other than statements of historical facts, that address events or developments that management of the Company expect, are forward-looking statements. Forward-looking statements are frequently, but not always, identified by words such as “expects”, “anticipates”, “believes”, “plans”, “projects”, “intends”, “estimates”, “envisages”, “potential”, “possible”, “strategy”, “goals”, “objectives”, or variations thereof or stating that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative of any of these terms and similar expressions. Actual results or developments may differ materially from those in forward-looking statements. Treasury disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, save and except as may be required by applicable securities laws.

Since forward-looking information address future events and conditions, by their very nature they involve inherent risks and uncertainties. Actual results could differ materially from those currently anticipated due to a number of factors and risks. These include, but are not limited to, exploration and production for precious metals; delays or changes in plans with respect to exploration or development projects or capital expenditures; the uncertainty of mineral resource estimates; health, safety and environmental risks; worldwide demand for gold and base metals; supply chain issues related to the COVID pandemic or war in Ukraine; gold price and other commodity price and exchange rate fluctuations; environmental risks; competition; incorrect assessment of the value of acquisitions; ability to access sufficient capital from internal and external sources; and changes in legislation, including but not limited to tax laws, royalties and environmental regulations.

Actual results, performance or achievement could differ materially from those expressed in, or implied by, the forward-looking information and, accordingly, no assurance can be given that any of the events anticipated by the forward-looking information will transpire or occur, or if any of them do so, what benefits may be derived therefrom and accordingly, readers are cautioned not to place undue reliance on the forward-looking information.

Cautionary Note regarding Mineral Resource Estimates

This press release uses the terms measured, indicated and inferred mineral resources as a relative measure of the level of confidence in the resource estimate. Readers are cautioned that mineral resources are not mineral reserves and that the economic viability of resources that are not mineral reserves has not been demonstrated. The mineral resource estimate disclosed in this press release may be materially affected by geology, environmental, permitting, legal, title, socio-political, marketing or other relevant issues. It cannot be assumed that all or any part of an inferred mineral resource will ever be upgraded to an indicated or measured mineral resource category, however, it is reasonably expected that the majority of Inferred Mineral Resources could be upgraded to Indicated Mineral Resources with continued exploration. The mineral resource estimate is classified in accordance with the Canadian Institute of Mining, Metallurgy and Petroleum’s “CIM Definition Standards on Mineral Resources and Mineral Reserves” incorporated by reference into NI 43-101. Under NI 43-101, estimates of inferred mineral resources may not form the basis of feasibility or pre-feasibility studies or economic studies except for preliminary economic assessments. Readers are cautioned not to assume that further work on the stated resources will lead to mineral reserves that can be mined economically.

SOURCE Treasury Metals Inc.

Contact

Jeremy Wyeth, President & CEO, T: +1 416 214 4654; Orin Baranowsky, CFO, T: +1 416 214 4654; Email: info@treasurymetals.com, Twitter @TreasuryMetals