TSX: TML OTCQX: TSRMF

Highlights:

- Results from 14 holes for the Goldlund Project 2021 drilling campaign released today include significant intersections both within the PEA resource zone and along strike. Selected drill results include:

- GL-21-035 intersected 40.05 m grading 0.89 g/t Au in Zone 4, including 1.1 m grading 6.28 g/t Au, 0.95 m grading 13.10 g/t Au and 0.79 m grading 10.00 g/t Au;

- GL-21-044 intersected 32.0 m grading 0.76 g/t Au, including 1.1 m grading 3.81 g/t Au, 1.1 m grading 5.48 g/t Au and 1.0 m grading 6.28 g/t Au in Zone 4;

- GL-21-065 intersected 20.3 m grading 1.10 g/t Au, including 0.9 m grading 13.90 g/t Au and 1.0 m grading 3.32 g/t Au in Zone 5; and

- GL-21-066 intersected 5.0 m grading 6.79 g/t Au, including 1.0 m grading 21.00 g/t Au, 1.0 m grading 5.45 g/t Au and 1.0 m grading 4.20 g/t Au in Zone 5;

- Additionally, Treasury Metals is pleased to confirm the presence of silver within mineralized zones at Goldlund. The Company will be undertaking additional confirmatory work on the silver mineralization as this presents an opportunity for additional revenue at the Project.

TORONTO, Sept. 16, 2021 /CNW/ - Treasury Metals Inc. (TSX: TML) (OTCQX: TSRMF) (“Treasury” or the “Company”) is pleased to announce gold results from an additional 3,150 metres from 14 holes of a planned 30,000 metre diamond drilling program for 2021 at the Goldlund Gold Deposit (“Goldlund”) located within the larger 100% owned Goliath Gold Complex (the “Project” or “GGC”), which includes the Goliath, Goldlund and Miller deposits along a prospective 65-kilometre trend in Northwestern Ontario.

In addition, the Company is also pleased to announce that the first batch of silver results have been received, confirming the presence of silver at Goldlund. Previously, Goldlund had not been known for silver mineralization and little testing for silver had been completed. As part of the 2021 drill program, the Company began analyzing drill core for silver, as its presence could represent an additional revenue opportunity for Goldlund and the greater Project as a whole.

The Company has drilled approximately 20,000 metres (108 holes) to date at Goldlund. With assay results released today, gold assay results are pending on more than 5,750 metres (28 holes). Of the program to date, 88 holes have been drilled within the preliminary PEA resource, with 20 holes exploring targets outside of, and along strike of, the Goldlund Deposit.

Jeremy Wyeth, President and CEO of Treasury Metals, commented: “The drill results released today continue to illustrate solid intersections of mineralization, increasing our understanding of the geological controls at Goldlund. We are particularly encouraged by the results from the silver assays received from the drilling at Goldlund. Currently in the PEA, there is no contemplation of the recovery of silver at Goldlund. The results today represent an opportunity for further improvements to the economics of the Goliath Gold Complex through the potential from additional silver revenues over the life of the Project.”

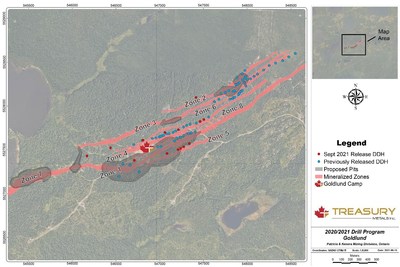

Figure 1: Goldlund 2021 Drill Collar Locations

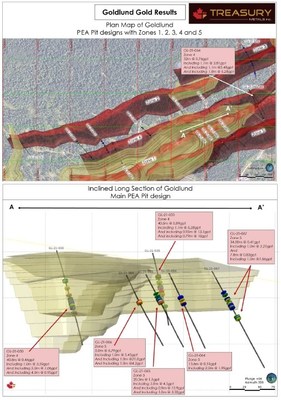

Gold results returned in September include infill holes on Zone 4, exploration on Zone 5 and two exploration holes targeting the edge of known mineralization.

The first targets on Zone 5 of the drill program show promising results with all four holes returning elevated gold values in the zone of mineralization. Hole GL-21-065 intersected 1.10 g/t Au over 20.30 metres, including 13.90 g/t over 0.90 metres and 3.32 g/t Au over 1.00 metre; GL-21-066 intersected 6.79 g/t Au over 5.00 metres, including 21.00 g/t Au over 1.00 metre, 5.45 g/t Au over 1.00 metre and 4.20 g/t Au over 1.00 metre; GL-21-064 intersected 0.51 g/t Au over 13.60 metres, including 1.99 g/t Au over 2.00 metres; and GL-21-067 intersected 0.41 g/t Au over 34.00 metres, including 3.21 g/t Au over 1.00 metre. These drillholes are on the edge, and just outside, of the PEA pit and represent potential opportunity for future expansion.

Drilling on Zone 4 continues to show mineralization in the footwall (the North side) of the main PEA Pit where GL-21-030 intersected 0.46 g/t Au over 40.80 metres, including 3.59 g/t over 1.00 metre, 1.06 g/t Au over 5.00 metres and 0.95 g/t Au over 4.00 metres; GL-21-035 intersected 0.89 g/t over 40.50 metres, including 6.28 g/t over 1.10 metres, 13.10 g/t Au over 0.95 metres and 10.00 g/t Au over 0.79 metres; and GL-21-044 intersected 0.76 g/t Au over 32.00 metres, including 3.81 g/t Au over 1.10 metres, 5.48 g/t Au over 1.10 metres and 6.28 g/t Au over 1.00 metres. Drilling targeting the south edge of Zone 3 strengthened our understanding of the cross faulting at Goldlund. The granodiorite body controlling mineralization on the two Northeastern pits appears to pinch out narrowing mineralization.

Table 1: New Significant Intercepts from recent drilling

|

Drill Hole |

Zone |

From (m) |

To (m) |

Sample Length (m) |

Grade g/t Au |

|

|

GL-21-030 |

Zone 4 |

93.20 |

134.00 |

40.80 |

0.46 |

|

|

including |

93.20 |

94.20 |

1.00 |

3.59 |

||

|

and including |

114.60 |

119.60 |

5.00 |

1.06 |

||

|

and including |

130.00 |

134.00 |

4.00 |

0.95 |

||

|

GL-21-035 |

46.75 |

86.80 |

40.05 |

0.89 |

||

|

including |

46.75 |

47.85 |

1.10 |

6.28 |

||

|

and including |

72.45 |

73.40 |

0.95 |

13.10 |

||

|

and including |

79.39 |

80.18 |

0.79 |

10.00 |

||

|

GL-21-044 |

Zone 4 |

36.00 |

68.00 |

32.00 |

0.76 |

|

|

including |

42.30 |

43.40 |

1.10 |

3.81 |

||

|

and including |

46.70 |

47.80 |

1.10 |

5.48 |

||

|

and including |

67.00 |

68.00 |

1.00 |

6.28 |

||

|

GL-21-046 |

Zone 4 |

47.00 |

52.80 |

5.80 |

3.53 |

|

|

including |

50.00 |

51.40 |

1.40 |

9.57 |

||

|

and including |

52.00 |

52.80 |

0.80 |

3.41 |

||

|

GL-21-046 |

Zone 1 |

148.00 |

169.00 |

21.00 |

0.31 |

|

|

including |

165.90 |

166.60 |

0.70 |

2.10 |

||

|

GL-21-049 |

Zone 4 |

126.40 |

138.20 |

11.80 |

1.12 |

|

|

including |

128.20 |

129.00 |

0.80 |

6.39 |

||

|

and including |

135.70 |

136.40 |

0.70 |

2.85 |

||

|

GL-21-049 |

Zone 4 |

159.00 |

176.30 |

17.30 |

0.89 |

|

|

including |

165.00 |

166.00 |

1.00 |

7.06 |

||

|

GL-21-065 |

Zone 5 |

38.50 |

58.80 |

20.30 |

1.10 |

|

|

including |

55.00 |

58.80 |

3.80 |

4.50 |

||

|

including |

56.00 |

56.90 |

0.90 |

13.90 |

||

|

and including |

57.80 |

58.80 |

1.00 |

3.32 |

||

|

GL-21-066 |

Zone 5 |

53.50 |

58.50 |

5.00 |

6.79 |

|

|

including |

53.50 |

54.50 |

1.00 |

5.45 |

||

|

and including |

54.50 |

55.50 |

1.00 |

21.00 |

||

|

and including |

57.50 |

58.50 |

1.00 |

4.20 |

||

|

GL-21-067 |

Zone 5 |

43.00 |

77.00 |

34.00 |

0.41 |

|

|

including |

73.00 |

74.00 |

1.00 |

3.21 |

||

|

GL-21-070 |

Zone 3 |

202.80 |

206.00 |

3.20 |

1.68 |

|

|

including |

204.00 |

204.60 |

0.60 |

4.80 |

||

|

GL-21-070 |

Zone 6 |

297.00 |

298.00 |

1.00 |

11.10 |

Note: Reported intervals are drilled core lengths and do not indicate true widths. For duplicate samples, the original sample gold assays are used to calculate the intersection grade. All grades are un-capped

The first batch of silver results have been returned for 2021 Goldlund drilling. Maura Kolb, Director of Exploration stated “We are pleased to see silver mineralization within the gold mineralized zones. It is early, but we are optimistic that silver can be added to the Goldlund resource and are scoping out a program to go back and sample historic core for silver.”

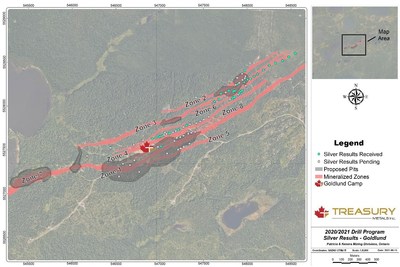

Figure 3: Goldlund Silver Assay Locations

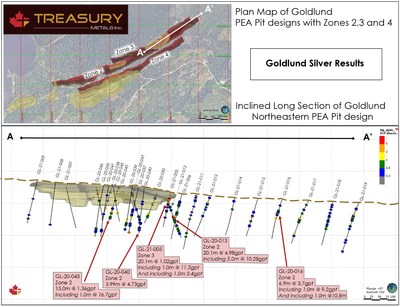

Drilling targeting the Northeastern pit (Zones 2 and 3) intersected favourable silver results such as hole GL-21-013 which intersected 4.98 g/t Ag over 20.10 metres including 10.28 g/t over 5.00 metres and hole GL-21-016 with 3.70 g/t Ag over 6.90 metres, including 1.00 metre at 9.20 g/t Ag and 1.00 metre at 10.80 G/t Ag.

Table 2: New Significant Silver Intercepts

|

Drill Hole |

Zone |

From (m) |

To (m) |

Sample Length (m) |

Grade g/t Ag |

|

|

GL-20-040 |

Zone 2 |

160.75 |

163.74 |

3.99 |

4.73 |

|

|

GL-20-043 |

Zone 2 |

74.00 |

89.00 |

15.00 |

1.36 |

|

|

including |

88.00 |

89.00 |

1.00 |

16.70 |

||

|

GL-21-005 |

Zone 3 |

15.90 |

36.00 |

20.10 |

1.02 |

|

|

including |

15.90 |

16.90 |

1.00 |

11.50 |

||

|

and including |

22.00 |

23.00 |

1.00 |

3.40 |

||

|

GL-21-013 |

Zone 2 |

86.00 |

106.10 |

20.10 |

4.98 |

|

|

including |

95.10 |

100.10 |

5.00 |

10.28 |

||

|

GL-21-016 |

Zone 3 |

50.10 |

57.00 |

6.90 |

3.70 |

|

|

including |

50.10 |

51.10 |

1.00 |

9.20 |

||

|

and including |

54.10 |

55.10 |

1.00 |

10.80 |

Note: Reported intervals are drilled core lengths and do not indicate true widths. For duplicate samples, the original sample assays are used to calculate the intersection grade. All grades are un-capped

Figure 4: Silver Results at Goldlund, plan map and long section showing northeastern PEA pit design

Complete results from the 2020/2021 drill program at Goldlund can be found here on the Treasury Metals website.

The exploration program has been designed to ensure the safety of the workforce and surrounding communities during the COVID-19 pandemic and incorporates enhanced operating protocols that are consistent with local health guidance.

QA / QC

The Company has implemented a quality assurance and quality control (QA/QC) program to ensure sampling and analysis of all exploration work is conducted in accordance with the CIM Exploration Best Practices Guidelines. The drill core is sawn in half with one-half of the core sample dispatched to Activation Laboratories Ltd. facility located in Dryden, Ontario. The other half of the core is retained for future assay verification and/or metallurgical testing. Other QA/QC procedures include the insertion of blanks and Canadian Reference Standards for every tenth sample in the sample stream. A quarter core duplicate is assayed every 20th sample. The laboratory has its own QA/QC protocols running standards and blanks with duplicate samples in each batch stream. Additional checks are routinely run on anomalous values including gravimetric analysis and pulp metallic screen fire assays. Gold analysis is conducted by lead collection, fire assay with atomic absorption and/or gravimetric finish on a 50-gram sample. Check assays are conducted at a secondary ISO certified laboratory (in this case AGAT Laboratories located in Mississauga, Ontario) following the completion of a program.

Qualified Persons

Maura Kolb, M.Sc., P.Geo., Director of Exploration and Adam Larsen, P. Geo., Exploration Manager, are both considered as a “Qualified Person” for the purposes of National Instrument 43-101 Standards of Disclosure for Mineral Projects (“NI 43-101”), and have reviewed and approved the scientific and technical disclosure contained in this news release on behalf of Treasury.

About Treasury Metals Inc.

Treasury Metals Inc. is a gold focused company with assets in Canada. Treasury’s Goliath Gold Complex, which includes the Goliath, Goldlund and Miller deposits, is located in Northwestern Ontario. The deposits benefit substantially from excellent access to the Trans-Canada Highway, related power and rail infrastructure, and close proximity to several communities including Dryden, Ontario. The Company also owns several other projects throughout Canada, including the Lara Polymetallic Project, Weebigee-Sandy Lake Gold Project JV, and grassroots gold exploration property Gold Rock. Treasury Metals is committed to inclusive, informed and meaningful dialogue with regional communities and Indigenous Nations throughout the life of all our Projects and on all aspects, including: creating sustainable economic opportunities, providing safe workplaces, enhancing of social value, and promoting community well-being.

For information on the Goliath Gold Complex, please refer to the preliminary economic assessment, prepared in accordance with NI43–101, entitled “NI 43–101 Technical Report & Preliminary Economic Assessment of the Goliath Gold Complex: and dated March 10, 2021 with an effective date of January 28, 2021, led by independent consultants Ausenco Engineering Canada Inc. The technical report is available on SEDAR atwww.sedar.com, on the OTCQX at www.otcmarkets.com and on the Company website at www.treasurymetals.com.

To view further details about Treasury, please visit the Company’s website at www.treasurymetals.com.

Neither the TSX nor its Regulation Services Provider (as that term is defined in the policies of the TSX) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Statements

This release includes certain statements that may be deemed to be “forward-looking statements”. All statements in this release, other than statements of historical facts, that address events or developments that management of the Company expect, are forward-looking statements. Forward-looking statements are frequently, but not always, identified by words such as “expects”, “anticipates”, “believes”, “plans”, “projects”, “intends”, “estimates”, “envisages”, “potential”, “possible”, “strategy”, “goals”, “objectives”, or variations thereof or stating that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative of any of these terms and similar expressions. Actual results or developments may differ materially from those in forward-looking statements. Treasury disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, save and except as may be required by applicable securities laws.

Since forward-looking information address future events and conditions, by their very nature they involve inherent risks and uncertainties. Actual results could differ materially from those currently anticipated due to a number of factors and risks. These include, but are not limited to, exploration and production for precious metals; delays or changes in plans with respect to exploration or development projects or capital expenditures; the uncertainty of resource estimates; health, safety and environmental risks; worldwide demand for gold and base metals; gold price and other commodity price and exchange rate fluctuations; environmental risks; competition; incorrect assessment of the value of acquisitions; ability to access sufficient capital from internal and external sources; and changes in legislation, including but not limited to tax laws, royalties and environmental regulations.

Actual results, performance or achievement could differ materially from those expressed in, or implied by, the forward-looking information and, accordingly, no assurance can be given that any of the events anticipated by the forward-looking information will transpire or occur, or if any of them do so, what benefits may be derived therefrom and accordingly, readers are cautioned not to place undue reliance on the forward-looking information.

Note to United States Investors

All resource estimates included in this press release have been prepared in accordance with Canadian standards, which differ in some respects from United States standards. In particular, and without limiting the generality of the foregoing, the terms “inferred mineral resources,” “indicated mineral resources,” “measured mineral resources” and “mineral resources” that may be used or referenced are Canadian mining terms as defined in accordance with National Instrument 43 101 – Standards of Disclosure for Mineral Projects under the guidelines set out in the Canadian Institute of Mining, Metallurgy and Petroleum (the “CIM”) Standards on Mineral Resources and Mineral Reserves (the “CIM Standards”). The CIM Standards differ significantly from standards in the United States. While the terms “mineral resource,” “measured mineral resources,” “indicated mineral resources,” and “inferred mineral resources” are recognized and required by Canadian regulations, they are not defined terms under standards in the United States. “Inferred mineral resources” have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an inferred mineral resource will ever be upgraded to a higher category. Under Canadian securities laws, estimates of inferred mineral resources may not form the basis of feasibility or other economic studies. Readers are cautioned not to assume that all or any part of measured or indicated mineral resources will ever be converted into reserves. Readers are also cautioned not to assume that all or any part of an inferred mineral resource exists or is economically or legally mineable. Disclosure of “contained ounces” in a resource is permitted disclosure under Canadian regulations; however, United States companies are only permitted to report mineralization that does not constitute “reserves” by standards in the United States as in place tonnage and grade without reference to unit measures. Accordingly, information regarding resources contained or referenced in this [name of disclosure document] containing descriptions of our mineral deposits may not be comparable to similar information made public by United States companies.

SOURCE Treasury Metals Inc.

Contact

Jeremy Wyeth, President & CEO, T: +1 416 214 4654; Orin Baranowsky, CFO, T: +1 416 214 4654, Email: info@treasurymetals.com, Twitter @TreasuryMetals